|

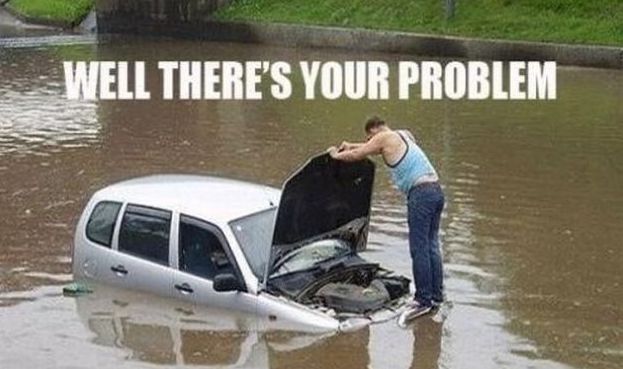

If you live in a 100-year floodplain and have a mortgage, you don’t have to wonder if you need flood insurance - it’s required as a condition of your loan. If flood insurance is not required as a condition of your mortgage, you’re not obligated to carry it. However, there are a few things that you should know:

For more information about your flood risk and the potential cost of a flood to your home, go to https://www.floodsmart.gov/floodsmart/. Then contact me and we will make sure that your home is protected. Most people know that a homeowners or renter’s insurance policy is crucial when it comes to protecting your home from a fire or other disaster. However, if you want to safeguard your valuables from the unexpected, Jon Jepsen at SentryWest Insurance of Salt Lake City says there’s another important document you may be overlooking: a home inventory.

If disaster strikes and your home and belongings are destroyed, a home inventory makes the insurance claims process a lot simpler, and it helps you get your possessions replaced quicker. While creating this inventory may be a time-consuming task, it doesn’t have to be completely daunting. Check out the following simple tips for compiling your home inventory: • Details, details, details. A home inventory includes a comprehensive list of all your belongings, along with receipts, photos, and descriptions. • Divide and conquer. Instead of making one long list of your items, break it down by room and/or type of item, such as clothing, heirlooms, electronics, and jewelry. This will make the home inventory less overwhelming and decrease the chances that you’ll overlook something. • Know what your stuff is worth. If you have antiques, family heirlooms, or other valuables that don’t have receipts, you may want to have them appraised in order to determine their value. • Look behind closed doors. When taking your inventory, make sure you don’t overlook items that are stored in the closet, drawers, attic, or garage. Bicycles, holiday decorations, and sports equipment may be out of sight, but their cost adds up. Make sure you include everything – even if it’s in storage – on your list. • Add it up. Once you have a full document of all your belongings, along with their values, add up all the items in your home and their total cost. • Keep it safe. Store your complete home inventory with your insurance policy in a safe, easily accessible place, such as a fireproof box, safe deposit box, or other secure location. • Take stock annually. Remember to review and update your inventory each year, or whenever you make a significant purchase, to ensure your new items are documented. If you’re looking for a useful tool to help with your home inventory, keep an eye out for the new Trusted Choice mobile app, which includes a handy home inventory tool. Available in the Android Marketplace and iTunes App Store in February 2012. For help obtaining coverage for your posessions, contact Jon Jepsen at SentryWest Insurance in Salt Lake City, a Trusted Choice independent insurance agent. Winter is fast approaching and it’s time to think about steps you can take to prevent a burst pipe. Did you know that an average claim for a burst pipe is $35,000? And that doesn’t take into account all of the variable costs of your time and resources.

When water freezes, it expands. That’s why a can of soda explodes if it’s put into a freezer to chill quickly and forgotten. It’s the same for water in a pipe. If it expands enough, the pipe will burst, causing water to escape and resulting in serious damage. An eighth-inch (three millimeter) crack in a pipe can spew up to 250 gallons of water a day. By taking a few simple precautions, you can save yourself the mess, money and aggravation that frozen pipes cause. Before the Cold Hits

When the Temperature Drops

Before you Go Away (do you shut down a program location and/or your operations?)

If Your Pipes Freeze Don’t take chances. If you turn on your faucets and nothing comes out, leave the faucets turned on and call a plumber. If you detect that your water pipes have frozen and burst, turn off the water at the main shut-off valve in the structure; leave the water faucets turned on. [Never try to thaw a pipe with a torch or other open flame.] If you would like to make sure you are adequately insured for damage resulting from frozen pipes, please contact Jon Jepsen of SentryWest Insurance. Courtesy: Alliance of Nonprofits for Insurance |

AuthorJonny Jepsen, CIC Categories

All

|

|

|

|

RSS Feed

RSS Feed