|

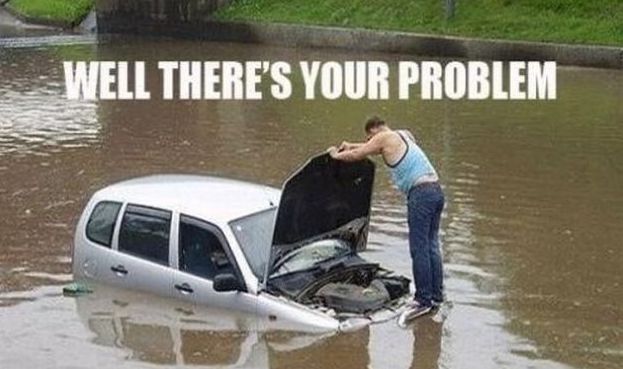

If you live in a 100-year floodplain and have a mortgage, you don’t have to wonder if you need flood insurance - it’s required as a condition of your loan. If flood insurance is not required as a condition of your mortgage, you’re not obligated to carry it. However, there are a few things that you should know:

For more information about your flood risk and the potential cost of a flood to your home, go to https://www.floodsmart.gov/floodsmart/. Then contact me and we will make sure that your home is protected. |

AuthorJonny Jepsen, CIC Categories

All

|

|

|

|

RSS Feed

RSS Feed