|

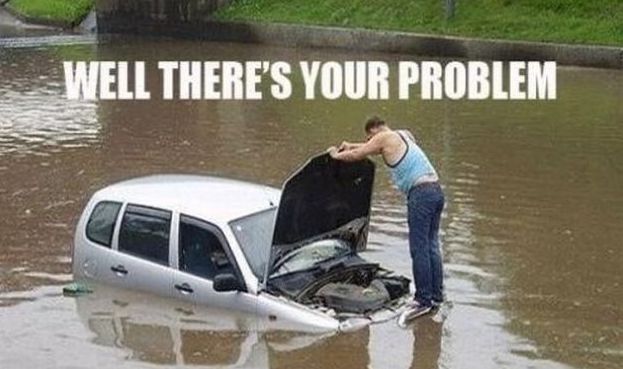

If you live in a 100-year floodplain and have a mortgage, you don’t have to wonder if you need flood insurance - it’s required as a condition of your loan. If flood insurance is not required as a condition of your mortgage, you’re not obligated to carry it. However, there are a few things that you should know:

For more information about your flood risk and the potential cost of a flood to your home, go to https://www.floodsmart.gov/floodsmart/. Then contact me and we will make sure that your home is protected. How many family members or friends do you know that are getting married this year? Wedding season is quickly approaching, and estimates show that over 2.5 million weddings will take place in the U.S. this year.

Here are a few things to remember about your exposure for these events:

Wedding claims examples:

Wedding season isn’t too far off! Protect your Homeowners policy and get an insurance policy that properly covers your wedding exposures. For more infromation on insuring a wedding, please contact Jon Jepsen at SentryWest Insurance in Salt Lake City, UT. It’s time for March Madness! Are you planning a blowout that will make render an entirely new meaning to “bracket busting?” Has your neighborhood community center asked for a either a hold-harmless agreement or a damage deposit exceeding your current mortgage payment?

Welcome to the world of personal event risk management! I know, super exciting stuff. While businesses are typically well versed in the insurance and contractual agreement vagaries of booking meeting rooms or convention locations, many individuals only encounter such complexities when it comes time for the family reunion, wedding or NCAA finals/Super Bowl/World Series/Nascar or just name-your-favorite-sport excuse for a big bash party. When it comes to needing protection for such events, will your current insurance coverage ride to the rescue or leave you standing at the altar? Am I Covered? For example, let’s say you’re renting a local meeting hall or church activity center for your daughter’s wedding reception. The owner of the facility asks you to sign a written lease agreement, including a section that states you agree to hold them harmless from any liability claims against them arising from your activities at their location. Will your homeowners policy protect you for liability claims against you arising from the reception? And what about that contract and hold-harmless? Good news on both fronts! Standard home insurance policies include liability protection for claims against you arising from “insured locations.” While that obviously includes your actual home or apartment, it also typically includes other locations you occasionally borrow or rent purely for personal use. And as for the lease and hold-harmless agreement, your policy also includes coverage for liability assumed under a contract related to the maintenance or use of an “insured location.” Potential Issues So far, so good. But while liability arising for injury to a guest at the location certainly can represent a huge potential exposure to loss, don’t overlook other critical issues. Here are just a few:

Clearly taking on the responsibility for such events goes far beyond negotiation of rental fees, color coordination of the decorations, and who is going to drive Uncle Fred home after his 15th trip to the punch bowl. But that is no reason to cancel your plans! When it comes to insurance and risk management questions, help is right here, with Jon Jepsen of SentryWest Insurance in Salt Lake City, your Trusted Choice® independent insurance agent. We are waiting to help you review these and other concerns. We’re armed with answers for what is already provided by your current insurance—including options for filling any gaps. And we have risk management tips to eliminate or minimize many potential sources of loss for others. Jon Jepsen: keeping March Madness about sports, not your personal risk. Party on! |

AuthorJonny Jepsen, CIC Categories

All

|

|

|

|

RSS Feed

RSS Feed